Snabbfakta

-

- Gävle

Ansök senast: 2024-11-25

Thesis proposal - Stock trading assistant

Titel:

Stock trading assistant

Background:

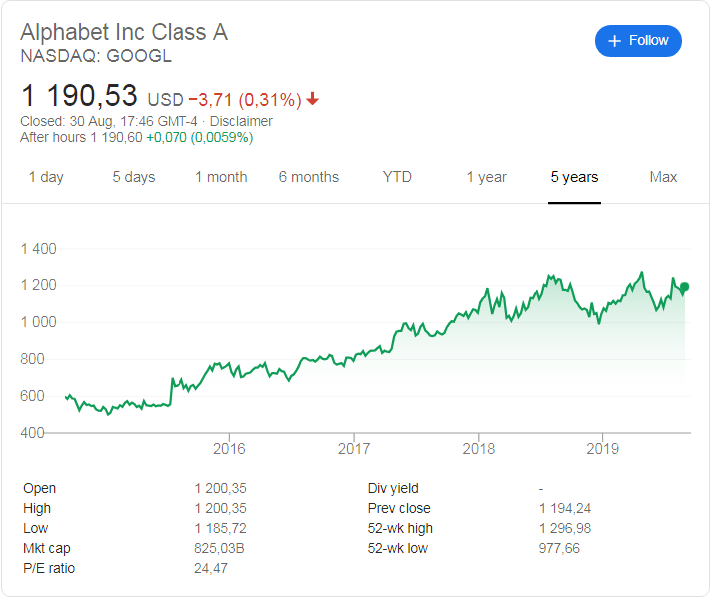

The idea of the stock market is for companies to raise money by offering a piece of ownership against money, called stock shares. A person could become an investor by buying a stock share from a company and thereby participate in the financial achievements of the company. The investor has the opportunity to earn profits by dividends and through capital gains made by the company. The company profits by getting capital for business expansion.

The price of a stock share is set by demand and supply and the company’s projected performance vs present value. A company that show a good earning potential way attract new buyers and thereby an increase in the share price. A poor looking company may attract more sellers than buyers. Since there are more sellers than buyers at the time period, the stock price will fall.

Certain events could also increase the price of a stock. For example information such as earning reports, political events and economic news. A medical company that wants to release a new medication could get a positive news report by getting accepted to sell this new medication.

Stock prices could also be effected by people mimicking actions of a larger group. For example if more and more people buys a certain stock and push the stock price higher and higher, other people would want to do the same since they may be assuming that the other investors may know something that they don’t know.

To maximize profit when trading stocks the goal is to buy a stock at the lowest price as possibly and sell it at the peak price.

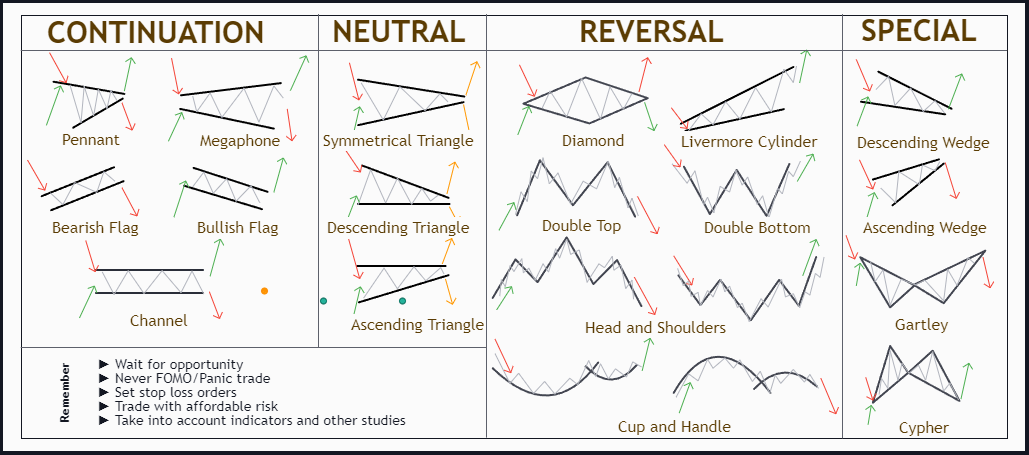

Level 1: Pattern recognition (day trading)

Train an AI to recognize patterns in a stock prize movement curve. The AI should recommend if there is an good opportunity to buy a stock at a certain price. It should also be able to tell when to sell the stock, by analyzing the current state of the price curve.

There are certain patterns to look for in day trading in order to analyze a stock buying

opportunity. Some of them are defined in the picture below:

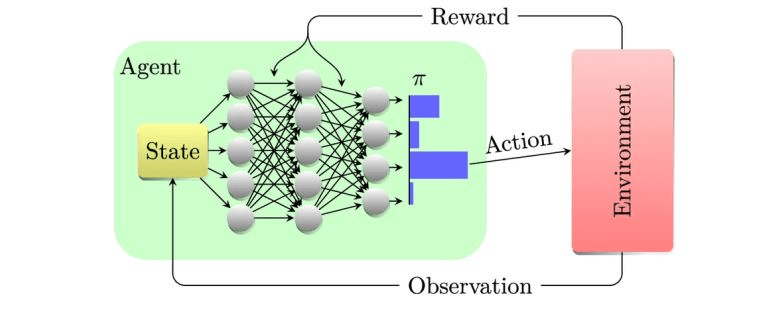

Level 2: Stock market simulation

Build a stock market simulation environment to train the AI in. Simulate stock prizes movement as realistic as possible, in order to give the AI as good and realistic data as possible. The AI could self take actions in the environment and get judged based on those actions (with an algorithm) using reinforcement learning.

Level 3: Positive news recognition

Design an AI to analyze a stock’s news. It should tell if a certain news will be positive for the stock price and tell you to buy or if the news will not affect the price. Start by training a language model (NLP) in order to analyze texts. Read more about NLP here: AI language models

Application:

We look forward to receiving your resume, and preferably, a personal letter in which you explain why you want to write your thesis with Syntronic.

We screen and evaluate applications on an ongoing basis.